Impulse purchases may be entertaining—at least in the short term. You go into Target looking for underwear, and before you know it… Chip and Joanna’s gorgeous pillow covers are all over your cart.

Every month, the americans Spend $183 on impulse.1 That’s around $6 each day, which isn’t too bad, right? However, that sums up to an additional $2,196 spent per year.

If you deposited $183 down every month for ten years and earned an 11 percent return, you’d have more than $39,000! Nothing beats interest charges for putting things in perspective.

Why is impulse spending so bad?

When you make a hasty buy, you risk jeopardising your savings and financial future. To begin with, paying your account using a credit card may make it increasingly challenging to wipe off your invoice at the end of the month. Sure, anyone can opt to pay simply the minimal amount due, but you’ll be charged fees. You could get yourself in debt if you’re not careful.

Worse, if you worry about paying your credit card bill, you’ll be charged fees and perhaps a penalty rate of interest. And that’s only the short-term consequences. In the long run, you’ll hurt your credit score, which will limit your lending options in the future. That is why we are here to assist you in avoiding impulsive purchases at all costs.

How to reduce your Impulse of Buying

Here are a few ideas to help you avoid the desire to take something you don’t require!

1. Refrain from yielding to temptation

What’s the greatest technique to avoid making a quick purchase? Rarely shop at stores that sell items you want to purchase! Especially ones that allow you to “purchase now, pay later”! This may involve avoiding shopping centres or restricting access to your preferred shopping websites. You’re going to be drawn to new shiny items if you’re continuously confronted by them. Don’t give in to the temptation, and you’ll know you’re just buying what you absolutely need.

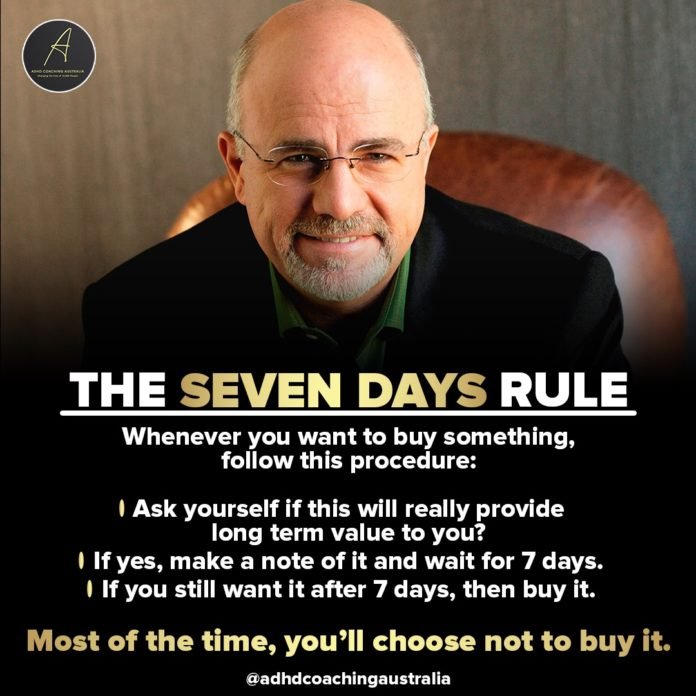

2. Take a moment to think about it

Before you go out and buy anything, consider why you’d need it.

Because they are afraid of losing out on a discount or a good price, up to 53.8 percent of women make impulsive buying. Worse, 36.4 percent of women claimed they purchased something on impulse because they didn’t have enough money.

3. Make a budget and stick to it

One of your key priorities should be costing. There are numerous financial possibilities to think about.Whatever plan you choose, you’ll most certainly divide your funds into a savings account, a debt finance, an essential necessities fund, and a life objectives help finance. Then, if you have sufficient money left over, you can create a personal expenditure category. This manner, you can limit your unplanned buying to the amount you cast aside for this category.

4. Consider your reasons for making an impulse purchase

Impulse purchase is a means for an individual to seem attractive to others. You may be anxious about how others view you. Having new stuff can sometimes improve your appearance.

Others may conduct spontaneous buys as a result of being overly emotional. You may have difficulty controlling your feelings or be concerned about a certain issue. An impulsive buying is a purchase made just on rare occasion.

If any of these relate to you, you should tackle the cause of the problem instead of patching it up with a new purchase. Before trying to pull out your credit or debit card, take some deep breaths and consider your motivations.

5. Keep your cash and credit cards to a minimum

If you’re going out, only take cash with you so you do not even end up with credit card debt on the spur of the moment. On a given transaction, credit card users spend up to 83 percent more than money users. If you have a problem with online buying, you may wish to put your debit cards on hold. You can do this by calling the number that issued your credit card.

6. Avoid using social media.

Nowadays, connecting with friends on facebook is more about sponsored content and affecting than it is about connecting with friends. Even if you only use it to check in on your loved ones, you’ll be exposed to a lot of information.

Those ads are also powerful. According to statistics, 55% of consumers have purchased products through a social media outlet. To avoid to become a statistic, your best strategy is to stay away from social media entirely.